Economy & Equity

Why economic inequality in India is raising phenomenally? । ECONOMIC INEQUALITY । INDIA BILLIONAIREShttps://www.youtube.com/watch?v=AE1ycar995I Discussion with Arun Kumar

Why inequality is India’s worst enemy https://www.downtoearth.org.in/blog/economy/why-inequality-is-india-s-worst-enemy-75778

India’s per capita gross domestic product (GDP) increased five times between 2000 and 2019; to $2014 in 2019 from $443 in 2000.

This doesn’t mean that income of the entire population has increased. The top one per cent in India earned 21 per cent of total country’s income in 2019. This was 11 per cent in 1990.

The top 10 per cent earned 56 per cent of the country’s total income in 2019; the bottom 10 per cent earned only 3.5 per cent.

Wealth distribution tells a similar story. The richest 10 per cent Indians owned 80.7 per cent of wealth in 2019.

The Gini (inequality in income distribution) coefficient points to an increasing inequality in India. The coefficient in 2014 was 34.4 per cent (100 per cent indicates full inequality and 0 per cent full equality).

India’s economic growth has slowed down significantly. This is the time when states need to invest: Money has to go into the hands of the marginalised.

States earn money through taxation. Increasing tax on the wealthy people is the obvious solution. Piketty also proposed a similar measure to reduce inequality. A higher rate of income tax for billionaires can be a way to generate more revenue for the state.

In any case, disinvestment of Central Public Sector Undertakings and public sector banks can’t be a permanent solution in an economy where inequality is rising sharply.

There is a need to track what is happening in the poverty pockets of India. A periodic study may help policy makers to think about the issue more seriously and come up with better ideas to reduce inequalities.

Tamil Nadu Finance Minister Dr. PTR Palanivel Thiaga Rajan on Plans to Revive the State Economy https://www.youtube.com/watch?v=qz00ypCdpVs

The TN finance Minister..

Navika Kumar today, tune in to the significant development on the GDP results coming in the midst of the second Covid wave on its peak and its rising impacts behind it. Despite several economic setbacks, the numbers saw a jump start in Q4, which the NDA appreciated, seen as a revival scope. However, the opposition had major concerns regarding the situation, calling it the worst in the past 4 decades. India has left negativity behind, and the FY 2020-2021 ends on a positive note. Last quarter sees 1.6% +ve GDP, and a mega 56% jump in core sector recorded. Adding to this hopeful result, Sambit Patra, National Spokesperson, BJP, states that 2 consecutive quarters of positive growth really indicates that the trajectory is toward upward movement and revival. https://www.youtube.com/watch?v=aqn4Xoycpc4

Navika Kumar asks us not to blame the Prime Minister, as COVID has affected all economies, and we are seeing silver shoots.

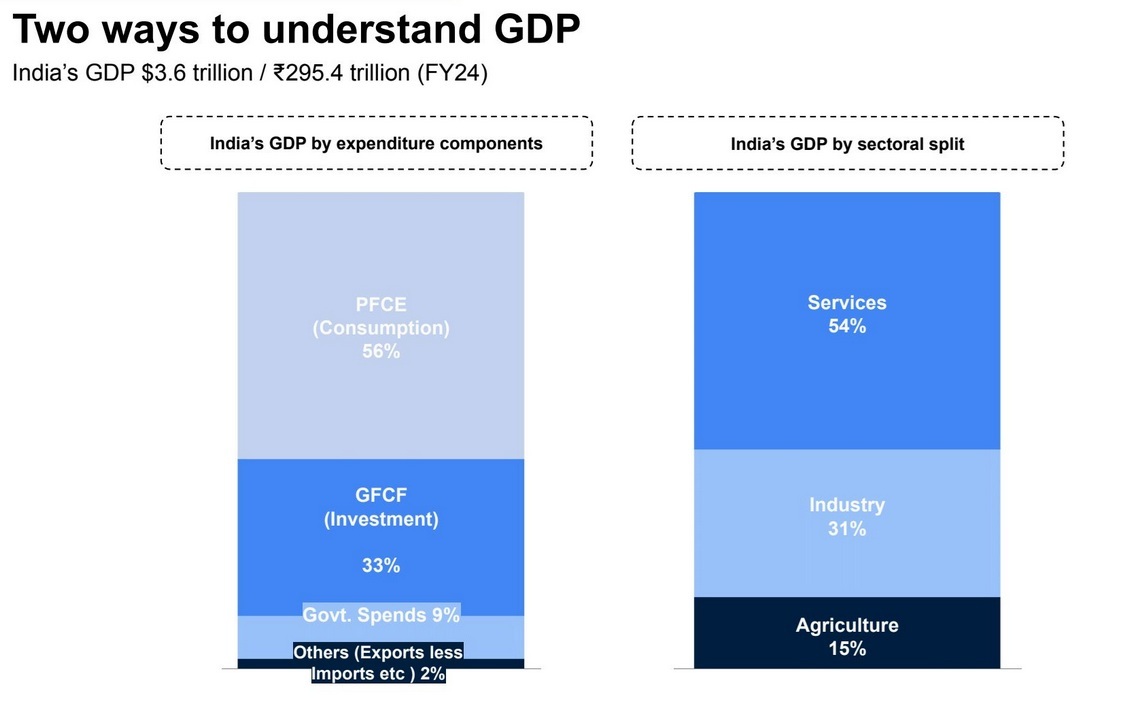

100 crore Indians--90% of population--have no money to spend on non-essential items; 10% are consuming class: Report https://www.livemint.com/news/india/100-crore-indians-have-no-money-to-spend-on-non-essential-items-report-11740593010860.html a study by venture capital firm Blume Ventures..describes aspirant consumers as "heavy consumers and reluctant payers". It highlights that industries like OTT/media, gaming, edtech, and lending are particularly relevant to this segment. The introduction of UPI and AutoPay has facilitated small-ticket transactions, encouraging greater participation from this group in the economy... wealth is becoming more concentrated. Companies are increasingly focusing on premiumisation, a strategy that emphasises high-end, expensive products tailored for wealthier consumers. This trend is evident in the booming sales of luxury homes and premium smartphones, even as budget-friendly options struggle...The report concludes that India’s GDP remains heavily dependent on consumer spending. However, unless income distribution improves, businesses may increasingly cater only to high-income groups, further marginalising a significant portion of the population.

100 crore Indians--90% of population--have no money to spend on non-essential items; 10% are consuming class: Report https://www.livemint.com/news/india/100-crore-indians-have-no-money-to-spend-on-non-essential-items-report-11740593010860.html a study by venture capital firm Blume Ventures..describes aspirant consumers as "heavy consumers and reluctant payers". It highlights that industries like OTT/media, gaming, edtech, and lending are particularly relevant to this segment. The introduction of UPI and AutoPay has facilitated small-ticket transactions, encouraging greater participation from this group in the economy... wealth is becoming more concentrated. Companies are increasingly focusing on premiumisation, a strategy that emphasises high-end, expensive products tailored for wealthier consumers. This trend is evident in the booming sales of luxury homes and premium smartphones, even as budget-friendly options struggle...The report concludes that India’s GDP remains heavily dependent on consumer spending. However, unless income distribution improves, businesses may increasingly cater only to high-income groups, further marginalising a significant portion of the population.

full report: https://docsend.com/view/pyxuqunkm9ejw38q#

The Economic Rights Every Indian Should Have | Budget 2025 https://www.youtube.com/watch?v=MOyMtx-bWPw The Wire

people should have a set of fundamental economic rights.

1. right to food in which people everybody should be entitled to obtain food exactly on the same terms on which the BPL population used to obtain in the years before the

pandemic. Currently it is made out as a largess by the PM or ruling power..

2. right to employment. unemployment is the most serious crisis

facing the economy and of course the fact that people don't get employment is

not their fault. it's the fault of society that we live within a social Arrangement

3. Right to free Universal Health Coverage .

4. right to quality publicly funded education system supplemented by various charitable

organizations . but now by commercial private educational establishments and finally I believe.

5, Right to noncontributory universal pension scheme where

everybody gets a living pension and of course disability benefits

This would require an additional 7 % of GDP. tax.

which can be raised by a) a 2% wealth tax and b) an inheritance tax on the top 1% of the population.

budgets generally show an increase in infrastructure investment, some increase in the financial allocations in the form of transfers to the people but what is being taken away from them through the erosion in their living standards in real terms because of inflation and because of unemployment. giving out doles to the people actually devalues the role of the people as Citizens it appears as if the government is doing some charity towards them.

It should be a rights based program .

the citizens reacquire their dignity and in which a set of fundamental economic rights is

introduced and in which we actually delink from globalization by having bilateral agreements with other countries of the third world ..

- The Future of Inequality

- Towards Tax Justice and Wealth Redistribution in India

- Importance of Public Banking System

- Forme Secretary write to FM saying Asset monetisation counter productive

- BSNL paralysed

- Modinomics & LIC

- PSU Banks

- How to destroy the Indian Economy?

- Centre should privatise all PSBs, except State Bank of India: NCAER

- Roadshows in the US to sell IDBI Bank! Why not allow LIC to own it?

- Privatisation of PSBs Will Deal a Blow to Reservation, Government's Coffers

- RBI Director called PSU Bank Executives Scum!

- Banking Regulations: Should Corporates Own Banks?

- LIC IPO: DRHP likely this month, 20% FDI cap being proposed

- nationalize the loss making banks and privatize the profitable banks

- Legislation to Privatise Two Public Sector Banks?

- Defend Bank Nationalisation

- BMC scraps 1.8k vacant posts, hundreds of contract staff hit

- Medha Patkar on Current Economic Policy

- The Shadow Government Plundering the Public Purse

- And how common citizens are paying the price for bad Monopolies

- Employees of Mahavitaran Jalgaon zone against privatization.

- Issues with Privatisation of Essential Services and Free Speech Institutions

- SC Dismisses Kerala Govt's Plea Against Adani Group's Takeover of Thiruvananthapuram Airport

- Understanding Deregulation, Privatisation & Economic Reforms

- Pawan Hans Sale: Cayman Firm in Winning Bid Flayed By NCLT

- the biggest privatisation scam in India

- Welcome Kerala Legislative Assembly’s resolution opposing disinvestment of the LIC

- Where has all the silver gone?

- LIC IPO- Gross injustice to the smaller LIC policy holders, especially those belonging to the SCs/STs/OBCs

- How to kill LIC -story behind IPO

- The political economy of CPSE disinvestmen

- Companies Bought & Sold by different Prime Ministers

- Public Private Partnerships – Subsidy and Impunity for Private Corporations

- CEL Sale

- On Trend for Privatisation: Kanhaiya Kumar

- Privatisation of CEL

- Privatisation: What Does It Really Mean?

- Dayanidhi Maran Shows Mirror To Govt On NPA Write-off and Haircut To Corporates

- virtually extending the lease in perpetuity

- World Bank offers to help National Rail Plan B

- Privatising power distribution: A hoax

- Modi’s Monetisation Worse than Demonetisation.

- Economics of Monetisation of Assets

- Monetisation: Designed To Create 2-3 Monopolies

- Privatised Infrastructure by Adani Group

- To BEST: Why are we waiting for hours?

- Pre-Paid electricity meters to be like FASTAG!