Government Must Guarantee There Won't Be Monopoly, Says P Chidambaram | https://www.youtube.com/watch?v=FdrxJdaQ5Oo Aug 28, 2021

In an interview to NDTV, P Chidambaram, former Finance Minister and senior Congress leader, says several sectors are heading towards a monopoly or at the best a duopoly. "Government must guarantee there won't be a monopoly and that the bidder who has the capacity to convert it into a monopoly will be excluded from the bidding."

Is the lease rent additional revenue during the lease period? The figures of this should be brought out before leasing.

Leasing Out Assets Worst Option, Kaushik Basu Tells NDTV | The Big Fight https://www.youtube.com/watch?v=hhvXsDrf0b8&t=320s Aug 28, 2021

In an exclusive interview to NDTV, Kaushik Basu, Professor of Economics, Cornell University; former Chief Economist of the World Bank and former CEA, says "the broad idea of putting of putting to good use the government's assets is a very good idea, but the way in which the monetisation plan is being worked out is not the way to go. Leasing out the assets is the worst option; it would have been better to sell them."

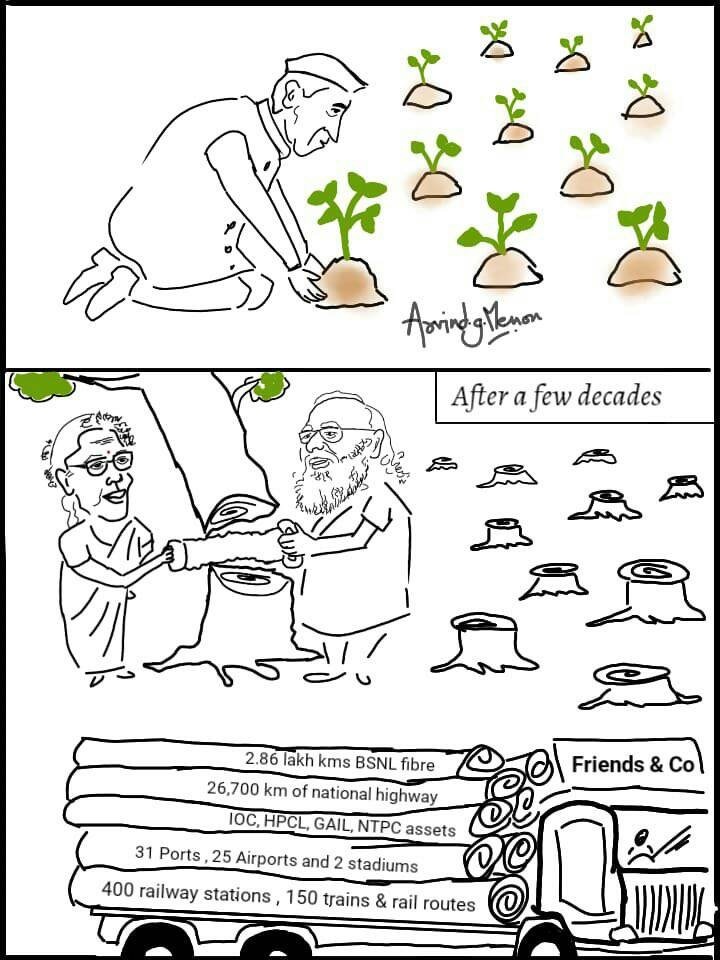

Why Is The Modi Govt. Selling The Nation's Assets? | National Monetisation Pipeline https://www.youtube.com/watch?v=flwGcjGtgi4 Aug 26, 2021

वित्त मंत्री निर्मला सीतारमण द्वारा छह लाख करोड़ रुपये की राष्ट्रीय मौद्रिकरण पाइपलाइन की घोषणा किए जाने पर सवाल उठाते हुए कांग्रेस नेता राहुल गांधी ने कहा कि यह सब कुछ कंपनियों का एकाधिकार बनाने के लिए किया जा रहा है. वहीं माकपा ने कहा कि सरकार ने देश ‘बेचने’ की आधिकारिक घोषणा की है. तृणमूल कांग्रेस ने सोमवार को दावा किया कि केंद्र की राष्ट्रीय मौद्रीकरण योजना (एनएमपी) ‘साठगांठ वाले पूंजीपतियों द्वारा सरकार का निजीकरण’ करने का उदाहरण है और इस ‘जन-विरोधी फैसले’ को तत्काल वापस लिया जाना चाहिए। इस मुद्दे पर द वायर की सीनियर एडिटर आरफ़ा ख़ानम शेरवानी ने अर्थशास्त्री अरुण कुमार से चर्चा की.

Business Tit-Bits: From Demonetisation To Monetisation | National Monetisation Pipeline | NMP https://www.youtube.com/watch?v=PWDiPU1U_u0 Aug 27, 2021

It was in her 2021 budget speech that the Finance Minister announced that a National Monetisation Pipeline (NMP) would be launched to monetise the operating public infrastructure, to finance the construction of new infrastructure. The declared purpose was to raise funds for the build up of much needed infrastructure in India, at a time when the government’s finances are very fragile. A wide and diverse range of government owned assets were proposed to be put on the block by the FM.

NITI Aayog Chief On India's Mega Monetisation Plan | Left, Right & Centre https://www.youtube.com/watch?v=j-o9phdSY1Y Aug 26, 2021 India unveiled the Rs 6 lakh crore National Monetisation Pipeline, under which the government will monetise assets by bringing in private sector participation in several key areas - roads, power, airports. The government says that it isn't selling any resources, only encouraging handing over key projects on a time-bound basis. Amitabh Kant, Chief Executive Officer of NITI Aayog, who is spearheading this initiative talks to NDTV on what the policy means.

''Asset Monetisation To Enhance Capex, Revive Credit Flow'': Amitabh Kant To NDTV https://www.ndtv.com/business/niti-aayog-ceo-amitabh-kant-on-national-monetisation-pipeline-nmp-to-ndtv-monetisation-is-not-privatisation-2518494 August 25, 2021

Under the National Monetisation Pipeline, the government will monetise assets worth ₹ 1.6 lakh crore from the roads sector, ₹ 1.5 lakh crore from railway sector and ₹ 79,000 crore from power sector

Pipeline Govt would be virtually extending the lease in perpetuity: https://www.cenfa.org/uncategorized/with-national-monetization-privatization-pipeline-govt-would-be-virtually-extending-the-lease-in-perpetuity-thomas-isaac/

September 22, 2021

Thomas Isaac “The government is claiming they are giving only temporary rights for certain duration (through the National Monetisation Pipeline). The key question is how the government will repay this investment that the private companies have made at the end of the period when they take back the assets. If the government says that whatever the investments the private players make would be taken over by the government at the end of the tenure, then there would be no takers. So, basically the government would be virtually extending the lease in perpetuity,” Thomas Isaac, the former Finance Minister of Kerala said.

Praveen Chakravarty: putting big capital assets on the block at a time when the economy is extremely weak, when private investment is very constrained, is only to favour a few big players as no one else will have the money now to invest in these assets.

Comrade Thomas Isaac on Issues With GST | CPIM Kerala https://www.youtube.com/watch?v=RtIDvG4kgLU Sep 2, 2020