Times Group's Samir Jain & Meera Jain Get Away with Small Penalty for Hiding Status as Promotors https://www.moneylife.in/article/times-groups-samir-jain-and-meera-jain-get-away-with-small-penalty-for-hiding-status-as-promotors/70406.html

Moneylife Digital Team 10 April 2023

In two separate orders related to Camac Commercial Company Ltd (CCCL) and PNB Finance & Industries Ltd (PNBFIL), SEBI imposed a total penalty of Rs2.82 crore each on Samir Jain and Meera Jain. In both cases, the market regulator has imposed a total penalty of Rs35.67 crore, including the fine on the Jains.

In both matters, SEBI’s investigation revealed that a group of 19 entities, connected through a complex web of networks and associations, was holding majority shares of eight companies, including that of CCCL, to the extent that they were holding shares beyond 75% of each of these eight companies. While seven out of the 19 entities were controlling the affairs of CCCL, in the case of PNBFIL, eight entities were in-charge. However, in both cases, Samir Jain and Meera Jain were neither disclosed as promoters nor as persons in control of the affairs and management of the companies.

Vickram Crshna on Whats app:

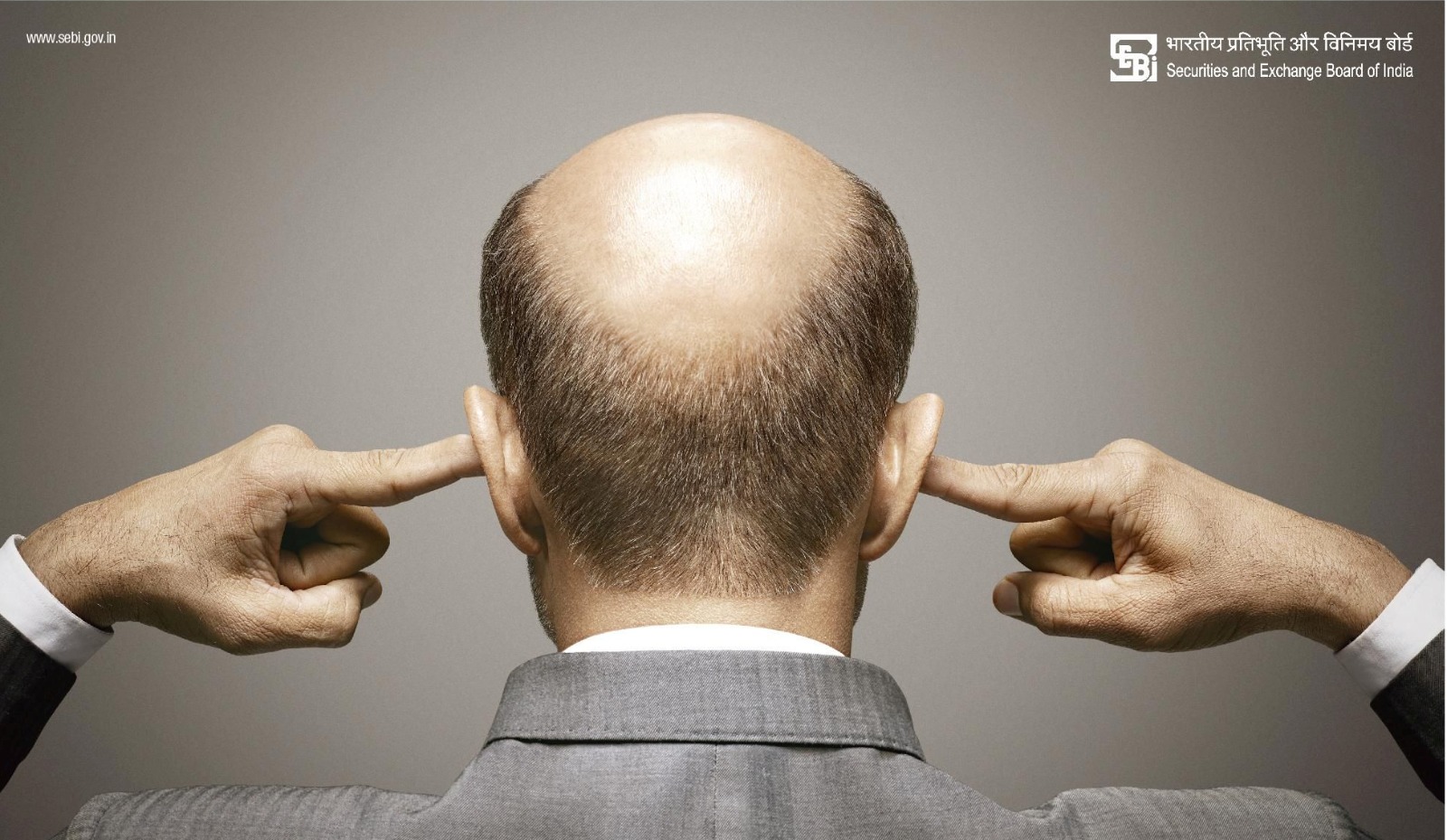

A Sebi ad:

And in the other issue, where the funds flows that are suspected of being instrumental in market valuations of a clutch of companies have been under suspicion for over two years, SEBI gets away with informing the court that the actual investigation, begun under pressure from the court, needs time.

The regulator ignored the matter being raised in Parliament two years back, apparently, or at least, has kept silent about what it was doing during this period, that it now needs to focus its investigations only upon the matters recently published in the USA.

For some reason, the court has also ignored the involvement of parliament long before the matter went public in the USA. The publication there, however, shredded the group market valuations, and that in turn hit valuations of many other Indian companies, in, evidently, an outcome that was pretty much going to be obvious.

SEBI's role, and competence, in managing this situation is not supposed to be the business of the Supreme Court, unless inaction is deliberate, and directed by sources unknown.

SEBI's role, and competence, in managing this situation is not supposed to be the business of the Supreme Court, unless inaction is deliberate, and directed by sources unknown.