Adanigiri

Notebandi के बाद Adani की संपत्ति utni बढी jitna RBI से नोट gayab हुये ? Reserve Bank of India https://www.youtube.com/watch?v=Jo_iUaKywOs

Notebandi के बाद Adani की संपत्ति utni बढी jitna RBI से नोट gayab हुये ? Reserve Bank of India https://www.youtube.com/watch?v=Jo_iUaKywOs

Oct 2, 2022 Notebandi के बाद Adani की संपत्ति utni बढी jitna RBI से नोट gayab हुये ? Reserve bank of India

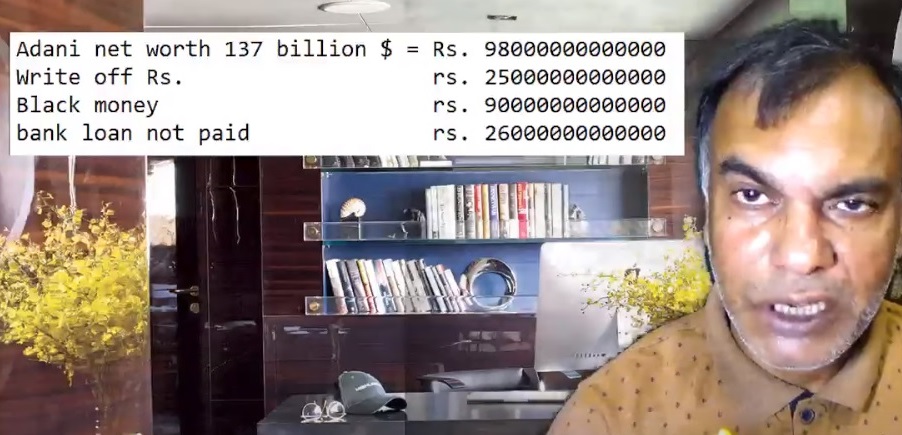

- नोटबंदी के समय अडानी की संपत्ति 3 अरब डॉलर आज 10 लाख करोड़ कैसे?

- RBI ने नोटबंदी तक 16 लाख करोड़ नोट छापे ! नोटबंदी के बाद 16 लाख करोड़ नोट छापे ! 16 लाख करोड़ नोट गायब कैसे हुये?

- कोई चोरी नहीं कोई डाका नहीं

Fishermen protesting against Vizhinjam port demanding rehabilitation and livelihood. Infrastructure Finance Update. August 2022 https://www.cenfa.org/fishermen-protesting-against-vizhinjam-port-demanding-rehabilitation-and-livelihood/ By Shivani Dwivedi | September 20, 2022

Adani Ports and Special Economic Zone (APSEZ) reported a 16.86% drop in consolidated net profit to Rs 1,091.56 crore for the first quarter of the current fiscal year on Monday. Adani Ports, which is constructing a transshipment port in Vizhinjam, Thiruvananthapuram, has petitioned the Kerala High Court for police protection against protesters protesting the development work. In their petition, the Adani Group claimed that the continued agitation by fishermen posed a threat to the lives of its employees and that, despite representations, the government was taking no action. Since a few weeks, a large number of fishermen have been protesting outside the main entrance of the multi-purpose seaport in nearby Mulloor, pressing their seven-point charter of demands, which include halting construction work and conducting a coastal impact study in connection with the multi-crore project. Protesters claim that the unscientific construction of bridges, or artificial sea walls as part of the future Vizhinjam port is one of the causes of the district’s increasing coastline erosion.

FISHING COMMUNITIES’ RESISTANCE AGAINST VIZHINJAM ADANI INTERNATIONAL SEAPORT, KERALA AJ Vijayan, Coastal Watch; Sharanya Raj, Convenor, K Rail Virudha Janakeeya Samithi;

Anto Elias, Kerala Swatantra Matsya Thozhilali Federation (KSMTF) https://www.facebook.com/NAPMindia/videos/2314581422035503

Will the corporates sink our banks? A credible study warns of over leveraging | MONEY TRAIL https://www.youtube.com/watch?v=mD7V6xnprFU

12 views Sep 5, 2022 'Take loans as much as you want and expand your empire' - this seems to be new corporate mantra. A study by CreditSights, affiliated to the credit rating agency Fitch warns about over leveraging. Indian corporates are investing less and depending more on loans and bonds. Though the study is more worried about bonds' sustainability what should worry us are our banks. Indian banks are so exposed to corporate loans - 45% of total loans - that if some of it goes bad it can bring down some banks. Nevertheless even PSU banks are getting more into corporate loan business. They are closing branches, cutting down staff strength and diminishing their presence in small loans sector. Choosing corporates over people for more profit. But on the doomsday it will cost heavily.

‘Gross environmental mismanagement’: Adani’s Udupi coal-power plant fined over US $6 million Ayaskant Das Jun 24, 2022 https://www.adaniwatch.org/_gross_environmental_mismanagement_adani_s_udupi_coal_power_plant_penalised India’s premier environmental court says the Udupi power plant has polluted local fields and villages with emissions, coal dust, fly ash and wastewater. Inhabitants have suffered respiratory diseases and impacts on their livelihoods due to loss of agricultural productivity. Will the Adani company pay the fine or will it launch a protracted set of appeals?

The Adani Group purchased the 2X600 Mega Watt (MW) power plant in April 2015 from the Indian business conglomerate Lanco Infratech which had been the largest private electricity supplier in the country.

Adani's Talabira coal mine: Communities resist being displaced for the second time in 70 years https://www.adaniwatch.org/talabira_project_story_3 Ayaskant Das Jun 01, 2022 In the Indian state of Odisha, hundreds of families are resisting dispossession and displacement by a sprawling coal mine. The Talabira II and III project is being developed by an Adani company. Many of the people in the path of the rapidly expanding excavations live in a state of anxiety because they have yet to be offered adequate compensation.