Risky Banking

Greed has made US banks crash again. Will we learn some lessons! THE MONEY TRAIL https://www.youtube.com/watch?v=CO3KmHgWKoo CFA India Mar 20, 2023 It is history repeating for the US. After the great bank crash of 2008 when more than 400 banks went down US government vowed that it will never happen again. But today they are staring at another crisis that may spiral in to a bigger on. This time bond markets failed them. Greed for profit made the now failed banks to invest in markets. Indian banks too are more into markets like never before. In the obsession to maximize profits they want to discourage the public too- shut down rural branches, deny loans, increase bank charges. Will we learn any lesson from US?

Meanwhile in the US, similar to the 2008, government is pumping loads of money to resurrect the banks. Most likely those responsible for the crisis may escape scot free as it was in 2008.

Will it affect India: https://youtu.be/CO3KmHgWKoo?t=341 State of our Banks. CRR requirements. Moving away from Mass banking.. and going into investments etc .

Thomas Franco .. https://youtube.com/embed/CO3KmHgWKoo?start=369&end=456 & https://youtube.com/embed/CO3KmHgWKoo?start=511&end=551 Public Sector bankers which are funding priority sector. the Govt should put an end to talk of privatisation

Recent loan write-off amounts exceeded the funds shortfall to replace old railway tracks and spending on three social sectors.

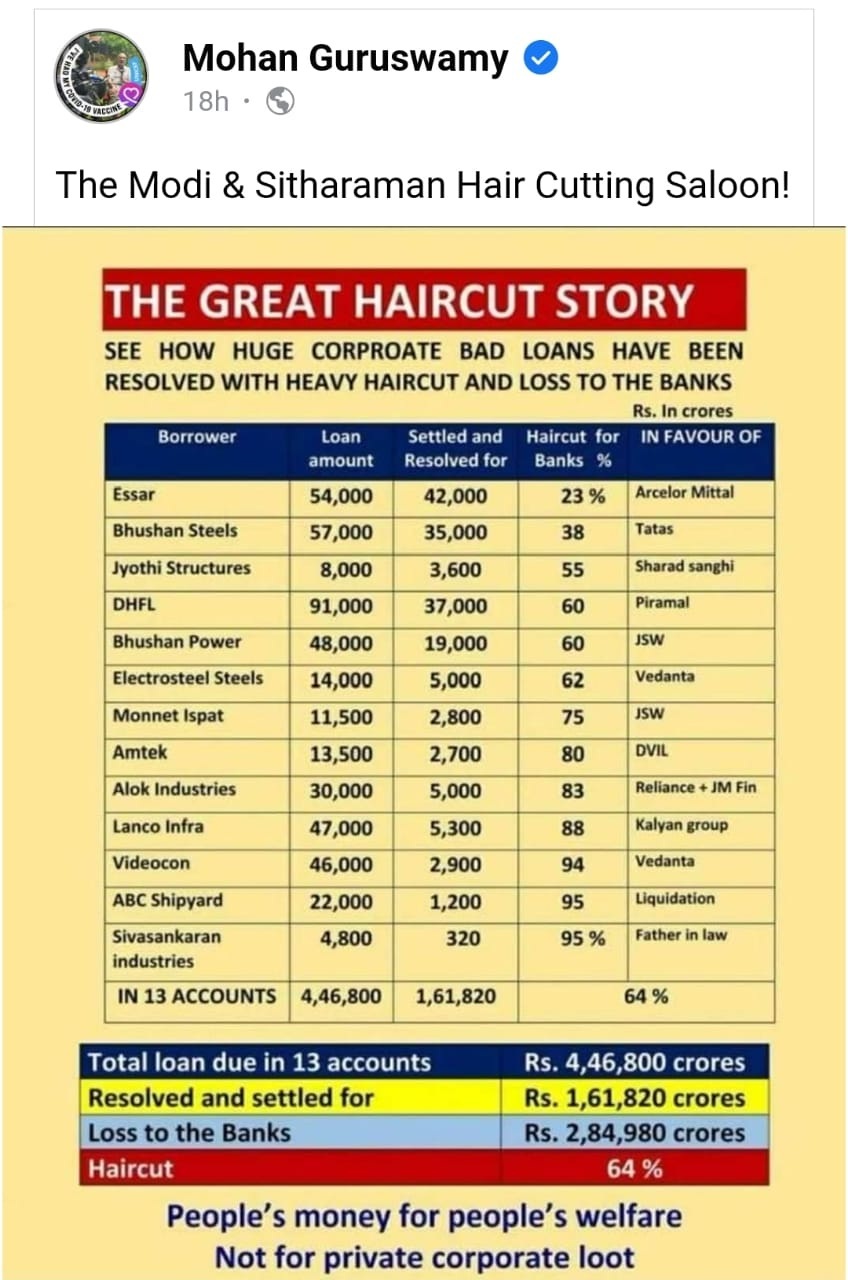

The compromise settlement mentioned in the Reserve Bank statement means that the outstanding balances of these wilful defaulters may be settled by mutual concession, with dues not being recovered completely. Far from strengthening the means to recover loans from wilful defaulters, the statement speaks of resettlement of the outstanding amount by means of “technical write-offs”.

This has been one of the key ways through which the non-performing assets of public and private sector banks have been shown to be declining in the last few years. It has emerged like a magic wand that makes the bad debt disappear from the balance sheets.

Write-offs by banks, both public and private, over the past 10 years have shown a phenomenal increase. Write-offs by public sector banks increased from Rs 7,187 crore in 2013 to Rs 119,713 crore in 2022. Among these public sector banks, the State Bank of India has in the last 10 years written off the highest total amount, at Rs 297,196 crores.

by Anirban Bhattacharya & Pranay Raj

26/06/2023

312 Big Wilful Defaulters Owe Rs 1.41 Lakh Crore to Public Sector Banks; Here Is the List of Bank Defaulters Yogesh Sapkale 10 August 2022 https://moneylife.in/article/312-big-wilful-defaulters-owe-rs141-lakh-crore-to-public-sector-banks-here-is-the-list-of-bank-defaulters/68026.html According to data obtained under Right to Information (RTI) and analysis done by Pune-based Vivek Velankar, as of 31 December 2021, nearly 2,237 wilful defaulters have an outstanding of Rs1,84,863.32 crore. While RBI had shared a list of names of 2,278 wilful defaulters, there are 41 borrowers against whom there is zero outstanding. "I found 11 defaulters have obtained a loan from State Bank of India (SBI) and other PSBs. These wilful defaulters are ABG Shipyard Ltd, Concast Steel & Power Ltd, EMC Ltd, Rohit Ferro-Tech Ltd, Best Foods Ltd, Coastal Projects Ltd, Wind World (I) Ltd, Era Infra Engineering Ltd, BS Ltd, Rei Agro Ltd and Raj Rayon Industries Ltd," Mr Velankar says.

Moneylife coverage on the issue: https://www.moneylife.in/tags/bankloot.html

Avantha Group Promoter Gautam Thapar Arrested In Money Laundering Case https://www.ndtv.com/india-news/avantha-group-promoter-gautam-thapar-arrested-in-money-laundering-case-2502046 The ED has been probing an alleged transaction between his company Avantha Realty, Yes Bank co-founder Rana Kapoor and his wife, who are already being investigated under the PMLA by the agency. The (CBI) FIR alleges that Rana Kapoor, then MD and CEO of Yes Bank Limited, obtained illegal gratification in the form of a property in a prime location in Delhi at much less than the realisable market value belonging to Avantha Reality Ltd f