Human Rights Defenders Data Information Knowledge Solidarity

HRDs must counter State's offensive of intimidating ordinary people, from expressing their opinion on social media or on various issues . Lawyers as well as Journalists, and youtubers bring these cases up in the public eye in order to youth to feel more secure speaking out.. This series we will document case law as well as reports through links to documents, reports from various websites and Blogs and Posts of HRDs. This is also an attempt to publicise all the dirty tricks State have been using. This is a contributory effort..

देश छोड़ भागने की तैयारी में Adani बस Modi की कुर्सी जाने का इंतज़ार ! Adani's Loan exposed https://youtu.be/1rR5tEiZnHA?t=92

DESH NEETI

Adani को मिले 20 हजार करोड़ किसके, सामने आ गया सच ? Hindenburg Report https://www.youtube.com/watch?v=cLcO0Xspxxw|

Aug 13, 2024 INDIA

धारवी अडानी के क़ब्ज़े में? | Adani's Control of Dharavi: Will it Affect Mumbai Lok Sabha Polls? https://www.youtube.com/watch?v=kfEZxEHCSrg

The Wire

Zeeshan Kaskar explores various aspects of the Dharavi Redevelopment Project.

The Dharavi Redevelopment Project's contract was awarded to Adani Group by the Maharashtra government. Having clinched the contract to revamp Asia's largest slum clusters back in November 2022, this initiative signifies a concerted effort towards urban renewal and inclusive development. Having said that, this project wil laffect the lives of millions of poor living here.

In the latest development concerning the Dharavi Redevelopment Project, the Adani Group has unveiled its pledge to furnish eligible residents of the Dharavi slum clusters with brand-new 350 sq ft residences, but the Dharavi residents say that they want new homes at the same place. This case has a lot of details regarding where the people of Dharavi would be relocated and who the current residents of Dharavi are. Watch this documentary to understand the past, present and the political future of Dharavi.

- Adani-Ambani .. Modi अपने ही जाल में फंस गए?

- story of Adani's World's Largest Renewable Energy Park

- SC verdict on Adani-Sebi

- Mahua Moitra speech on Adani

- Adani Group advisor’s presence on Environment Ministry’s expert committee flags conflict of interest

- Petition in SC: expert panel members relation with adani

- Supreme Court नहीं पहुँची Adani की SEBI Report

- Don’t Invest Public Money in high risk Adani Coal to PVC Plant

- Why Has the Adani-Hindenburg Issue Become a Matter of National Concern?

- Harayana Power Situation: Adani Group agreements

Subcategories

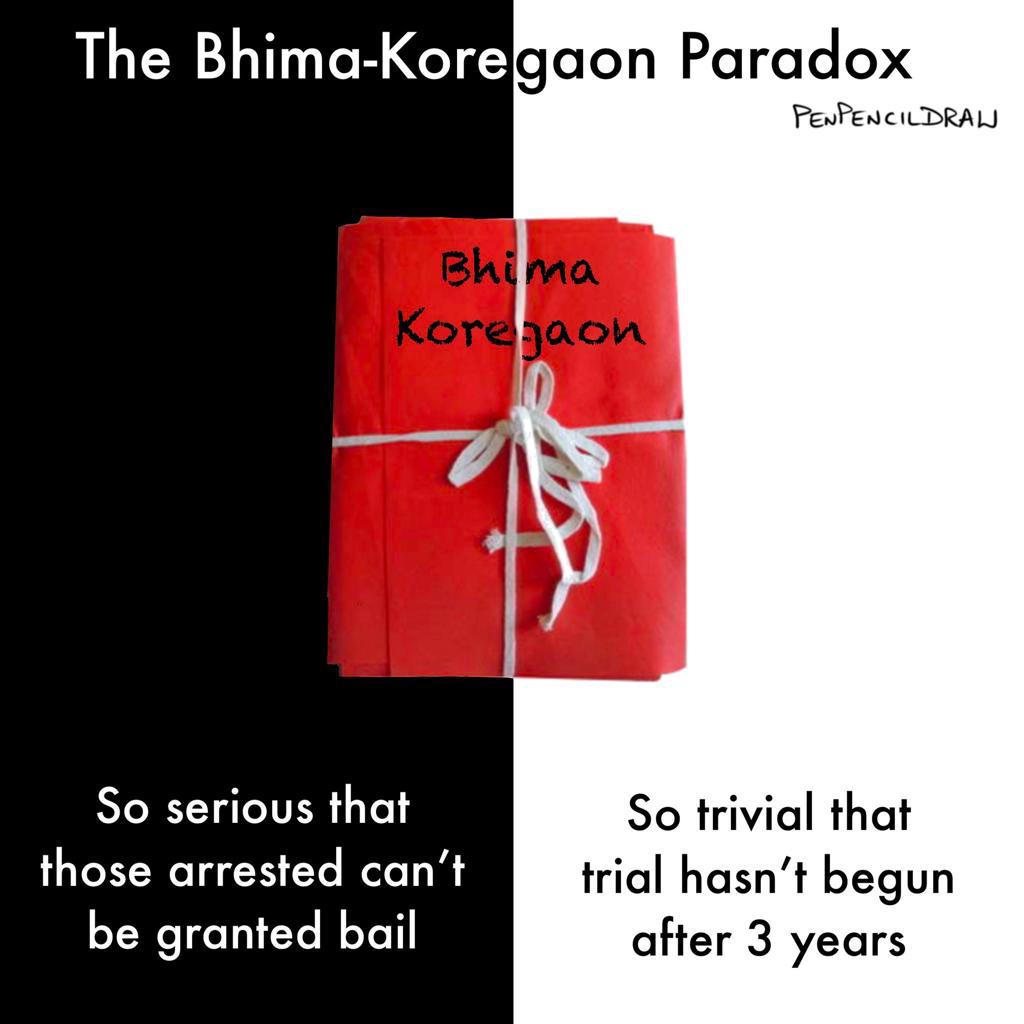

BAIL

For UAPA articles under

Free Speech

Ban on films, documentaries by Government e.g documentary on PM by BBC. Debate on censorship, opinion, statements by media people, leaders, screening of film on Modi at universities etc.

Corporate Behaviour and Free Speech

In a defamation case against Paranjoy Thakurta, a court has order, issued on September 6, directed the removal of defamatory content from their respective articles and social media posts within five days. In the suit filed by Adani Enterprises Ltd, seen by HT, the allegedly defamatory material includes transcripts of YouTube videos, screenshots of X posts by journalists, and images of their X profiles.https://www.msn.com/en-in/news/India/mib-issues-takedown-notices-to-13-digital-news-publishers-over-adani-defamation-case/ar-AA1MIjBR

Based on this, The ministry of information and broadcasting (MIB) on Tuesday issued takedown notices to 13 digital news publishers on YouTube and Instagram for disseminating defamatory content related to Adani Enterprises Ltd.The ministry’s order names journalists, media houses, and creators — including Newslaundry, Ravish Kumar, Dhruv Rathee, The Wire, HW News Network, and Aakash Banerjee’s The Deshbhakt — who have received a list of 138 YouTube video URLs and 83 Instagram links to be taken down.