Corporate Behaviour and Free Speech

In a defamation case against Paranjoy Thakurta, a court has order, issued on September 6, directed the removal of defamatory content from their respective articles and social media posts within five days. In the suit filed by Adani Enterprises Ltd, seen by HT, the allegedly defamatory material includes transcripts of YouTube videos, screenshots of X posts by journalists, and images of their X profiles.https://www.msn.com/en-in/news/India/mib-issues-takedown-notices-to-13-digital-news-publishers-over-adani-defamation-case/ar-AA1MIjBR

Based on this, The ministry of information and broadcasting (MIB) on Tuesday issued takedown notices to 13 digital news publishers on YouTube and Instagram for disseminating defamatory content related to Adani Enterprises Ltd.The ministry’s order names journalists, media houses, and creators — including Newslaundry, Ravish Kumar, Dhruv Rathee, The Wire, HW News Network, and Aakash Banerjee’s The Deshbhakt — who have received a list of 138 YouTube video URLs and 83 Instagram links to be taken down.

भारत सरकार के Pegasus से अडानी के लिए जासूसी की गई ?Adani की जांच कर रहे लोगों के मोबाइल में spyware https://www.youtube.com/watch?v=yDBo-TEGIC4

GIRIJESH VASHISTHA Nov 9, 2023 the use of the 'Pegasus' spyware by the Indian government to surveil the phones of Indian journalists. We will explore whether the Indian government employed Pegasus to hack into the phones of journalists following an OCRP report on Adani's wealth and whether the Modi government is monitoring journalists due to their reporting on Adani.

indian journalist targetted with NSO spyware https://www.reuters.com/world/india/indian-journalist-targeted-with-nso-spyware-anti-corruption-group-says-2023-11-07/ The journalist, Anand Mangnale, was among a series of people in India who received alerts from Apple (AAPL.O) last week warning them that they had been targeted by "state-sponsored" hackers trying to remotely access their iPhones. Apple's alerts did not identify the government behind the hacks or the spyware used.. OCCRP's co-founder Drew Sullivan told Reuters said an internal forensic investigation tied the intrusion effort against Mangnale's phone to Israeli firm NSO's Pegasus hacking tool. The spyware allows hackers sweeping access to the targets' smartphones, allowing them to record calls, intercept messages and transform the phones into portable listening devices.

Indian Journalists Targeted with State Intimidation and Spyware https://www.occrp.org/en/announcements/40-presss-releases/18198-indian-journalists-targeted-with-state-intimidation-and-spyware 08 November 2023 OCCRP Since OCCRP published an investigation in August that uncovered potentially controversial shareholders in India’s third-largest conglomerate, reporters who worked on the story have been targeted with state intimidation and surveillance attempts.

the investigation showed how two men who secretly invested in the Adani Group turned out to have close ties to its majority owners, the Adani family, raising questions about violations of Indian law. The Adani Group denies the allegations. Last month, OCCRP partner journalists Ravi Nair and Anand Mangnale were summoned by the crime branch of the Ahmedabad police in Modi’s home state of Gujarat to appear in person for questioning in a preliminary probe based on a complaint by a man identified only as “an investor” who claimed the investigation was “grossly malicious.” It is unclear why this is a police matter.

Mangnale’s phone has also been targeted with sophisticated spyware. According to iVerify, a Pegasus attack occurred within hours of sending out pre-publication questions to the Adani Group in August. There is no evidence the Adani Group had any role in the use of the surveillance tool.

The forensic analysis does not indicate which agency or government is behind the attack. (Pegasus is only licensed to governments.)

5 new reports on Adani Group. 5 new reports on Adani Group https://www.youtube.com/watch?v=Uzf1y74fR3o

Financial Times is the same newspaper about which Gautam Adani had said that he would like to create an institution like the Financial Times.

In fact, in the last 11 months, so much news has come about Adani Group that a separate news channel can be made for them too. Serious reports have come regarding more than a dozen different companies of Adani Group. In these reports, the correspondents have spent a lot of time, studied many documents and have also shown them in their reports. Even after this nothing happened. Every report comes like a ball and ends up hitting the wall. Three lines were published on News Click in New York Times, its office and that of more than 40 journalists associated with it were raided. The police interrogated and seized the phone and laptop. All the news related to Adani Group has been published in not one but many foreign and Indian newspapers but the investigating agencies did not have the courage to go to his office. In India, even minor allegations of corruption get investigated, this is one case on which continuous reporting has been going on for the last eleven months, opposition parties are raising their voice but there is no result.

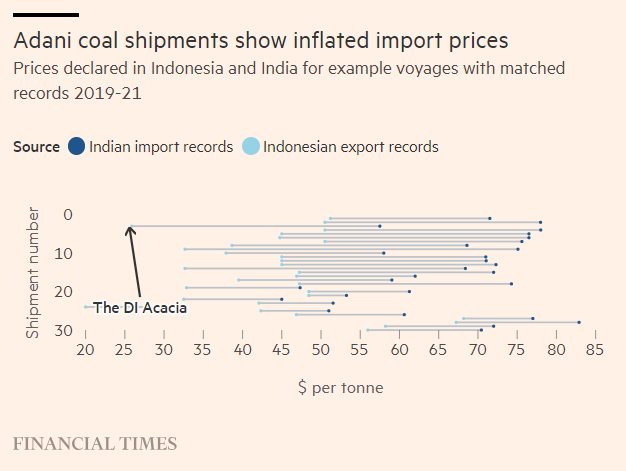

Overpricing of Coal Imports By Adani Group Led to Higher Profits, Customers Overcharged for Fuel: FT https://www.ft.com/content/7aadb3d7-4a03-44ba-a01e-8ddd8bce29ed

Overpricing of Coal Imports By Adani Group Led to Higher Profits, Customers Overcharged for Fuel: FT https://www.ft.com/content/7aadb3d7-4a03-44ba-a01e-8ddd8bce29ed

https://thewire.in/business/adani-coal-imports-over-pricing-customers-overcharged-fuel-ft A detailed FT investigation points to Adani’s use of “offshore intermediaries” to import $5 billion worth of coal at prices that were at times more than double the market price. One of these firms is owned by a Taiwanese businessman who was named by FT as a hidden shareholder in Adani firms...

in January 2019, coal meant for Adani, departed “the Indonesian port of Kaliorang in East Kalimantan carrying 74,820 tonnes of thermal coal destined for the fires of an Indian power station. While “in export records the price was $1.9mn, plus $42,000 for shipping and insurance. On arrival at India’s largest commercial port, Mundra in Gujarat run by Adani, the declared import value was $4.3mn.”

For 42 million tonnes of coal supplied by its own operations (in FY ending March 2023), the Adani group declared an average price of $130 per tonne. But for the 31 million tonnes of coal supplied by its three middlemen ( of doubtful ownership) , the average price declared per tonne was $155, per tonne. This was at a “20% premium worth almost $800 million.”

" these high costs translated directly into higher prices paid by consumers, especially in Gujarat where the opposition Congress party has already flagged the issue. In August this year, opposition politicians in Gujarat accused the state government of making almost $500 million in excess payments to Adani Power over five years under a power purchase agreement linked to the price of coal. “GUVNL paid Rs 13,802 crore ($2 billion) as energy charges to the company. But if coal rates as per Argus index is taken into consideration, then only Rs 9,902 crore ($1.5 billion) should have been paid,”

- मनमोहन ने बनाई थी हज़ारों करोड़ फर्जीवाड़े की CD

- Adani Group Rejects "Recycled Allegations" In OCCRP Report

- Is ORF behind Foreign Policy Or Ambani vs Adani

- SBI-led consortium to fund Adani Group’s ₹34,000-crore PVC project in Mundra

- Supriya Srinate on Adani Issue Gist interview

- What the Adani Story reveals about Indian Democracy

- George Soros ‘game plan’ revealed, wants “Democratic revival” in India

- Adani को Supreme Court की कमिटी ने कोई क्लीन चिट नहीं दी.

- False And Baseless', Mauritius Minister Rejects Hindenburg Claims On Adani Group

- Interview with Adani auditor